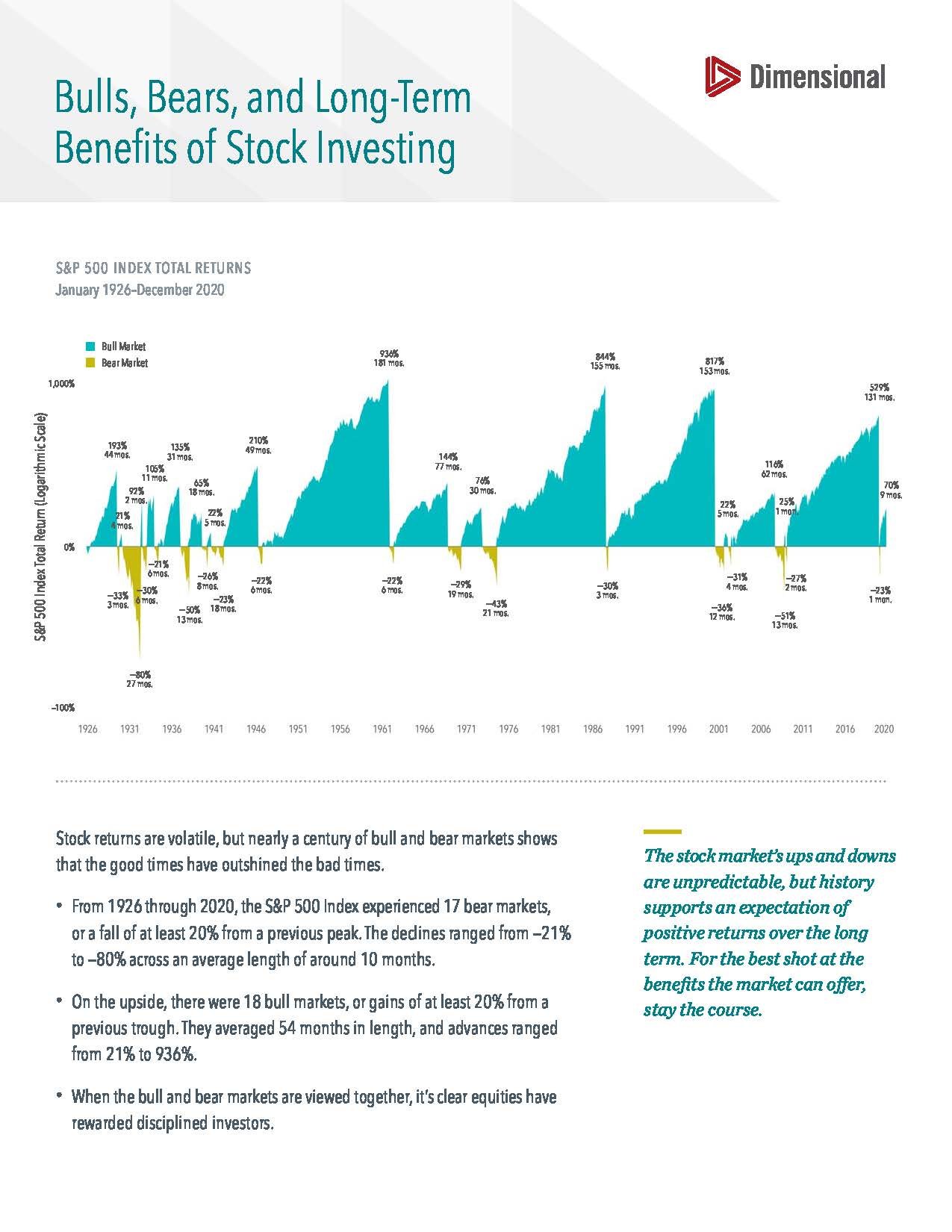

put up with the gold to be rewarded with the green (or is it teal or turquoise?). Stock market investing comes with bull (stocks up) and bear (stocks down) markets, but the bull markets are stronger and last longer. Think of the stock market as a constant bull market that is temporarily interrupted by short-lived bear markets. We don’t know when the next bear market will occur. It’ll happen at some point, fortunately, it won’t last long and it’s only temporary. If your retirement portfolio supports stock exposure, take the little bit of bad with a whole lot of good and stay invested through the good times and the bad times and you will build wealth for a safe, secure, and comfortable retirement. See the below picture or this PDF from Dimensional for more information.

ARE YOU CONFUSED BY THE CONTRAST IN THE ECONOMY AND THE STOCK MARKET?

Do you find it puzzling the recent stock market performance when you compare it to what is going on in the U.S. (and the world)? Each week millions more are filing for unemployment, the U.S. unemployment rate is north of 14%, bleak and dismal economic reports are coming out weekly, and now recent protests have led to nationwide unrest, riots, and looting…but the S&P 500 has rebounded about 38% from its March 23rd low, and it is currently at a price we saw in the beginning of March. It seems like it shouldn’t be this way, so why the disconnect?

It’s because stock markets are forward-looking. Meaning today’s prices reflect market participants’ combined expectations of future economic developments, not specifically what is happening right here right now. Remember stock is ownership in a company; holding stock entitles the stockholder to future earnings (and to participate in capital appreciation of the company), so investors care less about today and more about tomorrow.

Let’s go back to the end of February / beginning of March when we started to get a better understanding of what could happen with a novel coronavirus outbreak, and what could happen if we do something about it now or if we don’t do anything about it. It was a lot of speculation, dealing with an unknown, and preparing for the worst while hoping for the best. And the stock market and our retirement portfolios suffered drastically because of it, dropping 15% - 25% (depending on your allocation to stock) over just a couple weeks. Comparing now to then, investors believe better days are ahead.

Furthermore, stock markets are the first to react to good and bad news because it’s so easy for millions of market participants to put money into the system or take money out. Any type of unrest or uncertainty and the stock market quickly and easily goes down; likewise, any positive news, or even times when bad news isn’t as bad as expected and the stock market quickly and easily goes up. Remember, markets move quickly!

With that understanding, our approach is to use the stock market as it aligns with our personal financial and retirement goals. Whether economic uncertainty is prevalent today or a better economic outlook is popular now, whatever the case, we shouldn’t let the expectations of other market participants influence our personal decisions. We need to filter out the noise and not let it impact us nor our retirement portfolios. We use stock markets to align with our goals and our expectations, not the goals nor expectations of others.

ARE YOU A COFFEE DRINKER?

What if you only drank one specific type of coffee – one specific bean from a certain corner of the world? If suddenly that bean was no longer available, you’d be out of luck, you’d have no coffee to drink. Before the happens, does it make sense to dry different varieties, maybe a different brand with a little cream or sugar in it, or maybe hot tea instead? In a way, this is diversification…you are diversifying your palette by introducing different drinks to it. In the sudden event your favorite coffee is no longer available, you know you can fall back to something else for your morning cup.

We preach diversification…but in retirement planning. Our portfolios hold stocks in thousands of companies across the globe (and hundreds of bonds, too). We do this for a reason. Individual stocks are too risky for retirement planning. Relying on one stock or a handful of stocks to get us to retirement is like narrowing in on only one type of bean and not accepting any replacement. When it comes to our morning cup, we need to have some flexibility, and when it comes to our one chance at retirement, we need flexibility there, too.

Why the coffee analogy?

Luckin Coffee fired their CEO and COO, and suspended other employees amid a financial misconduct investigation. Their stock has been halted from trading for weeks and year to date it has lost about 90% of its value! How often have we heard ‘this is the next Amazon [or Apple, or Microsoft…]’, ‘this company can’t miss’, or ‘this company is too big to fail,’ until it isn’t the next Amazon, it does miss, or it does, in fact, fail. When people at the top are cooking the books, that’s something no investor can predict or plan for. Sure, those people get fired, maybe even go to jail, but unsuspecting stockholders suffer, too.

What if Luckin Coffee makes up a good chunk of your retirement portfolio? Now your portfolio just took a sizeable hit, a hit that can severely derail your retirement aspirations. But if Luckin Coffee is one of several thousand companies in which you hold stock, then it’s a tiny loss from where you will easily rebound, or not even notice in the first place. No matter how great the outlook for a company, bad things or bad people can happen. We can’t let bad things or bad people decimate our retirement portfolio. We prepare by properly positioning and insulating our portfolio with exposure to thousands of companies across the globe. It’s having our favorite cup of coffee, but knowing our spouse’s brand will make do in a pinch.

THE RISK AND LIABILITY OF OFFERING A 401(K) PLAN

You've done a great job helping your employees and yourself save for retirement. Congratulations, you just took on a bunch of risk and liability you didn't have before. Fortunately, our HCBA Retirement Solution can greatly reduce your risk and liability. Check out the below video to learn more.

HOW MUCH DOES A 401(K) PLAN TRULY COST?

Do you know how much your 401(k) plan costs? You should because it's money out of your pocket and if you're the plan sponsor / plan trustee you are held accountable for your plan's fee to be "fair and reasonable." Check out the below video to learn more.

THE BENEFITS OF AN AGGREGATE 401(K) PLAN SOLUTION

401(k) plans are a burden to administer and very time consuming. Wouldn't it be great to unload that burden and free up your time? When we handle your 401(k) plan, you'll be left to run your business and not your plan. Check out the below video to learn more.